A free checking account that helps teens learn to budget and manage their money.

Your teenage years are an exciting time to learn, grow, and build good habits. Start them off right with a teen checking account designed to facilitate the process of budgeting, sending and receiving payments, and managing money.

- No Fees - Fee-free means more money in your pocket.

- Low Initial Deposit - Just $25 to open an account.

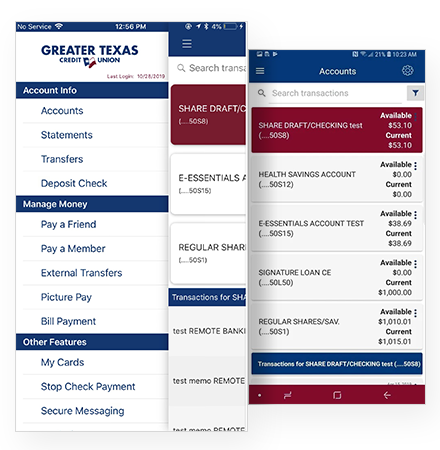

- Online Banking - Check account balances, transfer funds, pay bills, and more.

- Mobile App - All the functions of online banking with mobile convenience.

Newly Designed Mobile Banking App

Newly Designed Mobile Banking App

- View your account balance(s)

- View account activity

- Transfer funds

- Locate a branch or ATM

- Remotely deposit checks

The Teen Checking Account That Gives More

- Personalized Debit Card

- Use ATM’s For Free

- Nationwide Access

Want to Help Your Teen Start Saving?

With our Teen Share Saving Account they'll see that saved money can grow and learn to manage their money. As with all of our accounts, our member service team is here to provide you and your child unparalleled service and find the account that fits your needs.

- No Fees - Fee-free means more money in your pocket.

- Low Initial Deposit - Parents or guardians can open with just $5 in the teens name.

- Earn Dividends - Our Share Savings Accounts earn dividends paid quarterly, according to our rates.

★★★★★

“Fantastic bank! Flexibility of use with different branch locations, good online service, as well as quick and easy loan processing with great rates. As long as I live in Texas, I won't bank or do loans with anyone else. Great service!”

- Sonia G.

Frequently Asked Questions

Can I open a teen checking account online?

No. Accounts with primary members under the age of 18 must be opened in a branch.

What do I need to open a teen checking account?

A parent or guardian needs to be a Greater Texas Credit Union member and have a Texas Identification Card, Driver's License, or Passport.

If a parent or guardian does not have an account, a copy of their driver's license, social security card (or two valid picture IDs), and the child’s social security card are needed to open the account.

If a person other than the parent or legal guardian is opening the account, a letter from the legal guardian is needed as authorization.

The initial deposit to open the account is just $25.

How is this account different from your student account?

Our teen account is perfect for younger adolescents. It’s a basic account that’s great for learning how to budget, manage money, and make payments or receive deposits with the mobile app and bill pay.

Our student account has a few more features and benefits and is popular with college students. It offers overdraft protection and a chance to opt-in to take advantage of our overdraft privilege program.

Why is a deposit needed to open the checking account?

The $25 initial deposit to open a checking account is to verify funds for the account. It is available for access and withdrawal the next business day. After that, there are no monthly fees, and no minimum required balance for your checking account.

What kind of savings accounts does Greater Texas Credit Union offer?

When it comes to savings accounts, we offer a variety of options.

Our Regular Savings Accounts allow members to build up savings over time. Money Market Accounts offer higher interest rates than the regular option, or you can save for retirement with our IRAs.

Members can also save for the holidays throughout the year with our Christmas Club Accounts, or pay for health expenses through our tax-advantaged Health Savings Accounts.

Does there have to be a minimum amount in a checking or savings account at all times?

We do not require a minimum balance in the checking account just a $25 initial deposit.

For savings, the minimum account balance is $5.

How long does it take to receive my debit card by mail after opening a checking account?

Once the checking account has been opened and the debit card has been requested, it should take 3-5 business days to receive the debit card in the mail.