Plan For Your Future With Free Student Checking

Your life is busy. Between school, work, your social life, and spending time with family, you don’t want to add worrying about where you keep your money to the list. Opening a free student checking account allows you to ensure your funds are protected at a credit union you can trust while you enjoy your life.

Keeping a little cash on hand is fine, but nothing beats the ease of debit card access. What are you waiting for?

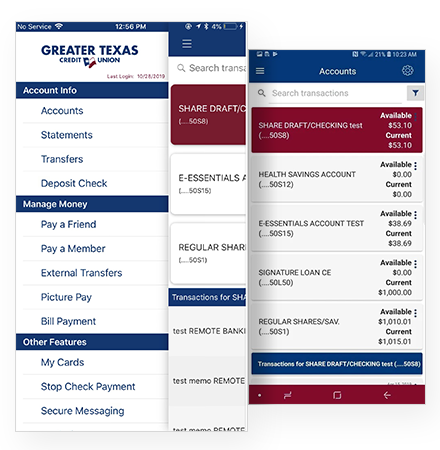

Newly Designed Mobile Banking App

Newly Designed Mobile Banking App

- View your account balance(s)

- View account activity

- Transfer funds

- Locate a branch or ATM

- Remotely deposit checks

Enjoy the Benefits of Free Student Checking

- Personalized Debit Card

- Unlimited Check Writing

- Nationwide Access

- Online & Mobile Banking

- Low Initial Deposit - Just $25 to open an account.

A Checking Account That Gives More

This might be your first checking account, or maybe you had one when you were younger. Either way, we’re here to help you make the best use of this account as you manage your current finances and as your financial needs grow in the future.

- Free Financial Education

- Refer-A-Friend Program Up to $500

- Access To The Latest Digital Payment Options

★★★★★

“Fantastic bank! Flexibility of use with different branch locations, good online service, as well as quick and easy loan processing with great rates. As long as I live in Texas, I won't bank or do loans with anyone else. Great service!”

- Sonia G.

Frequently Asked Questions

Can I open a Free Student Checking Account online?

Yes, members can open a truly free student checking account online. Non-members can establish their credit union membership online and open a checking account at the same time. Learn how to open an account online.

Do I have to be a member to open this account? Does every authorized user have to be a member?

Yes, you need to be a member to open a student checking account.

You can become a member by registering online or in a branch and opening a savings account. A checking account can be opened at the same time. All authorized users must qualify for membership, but do not need to previously be a member. Authorized users added to the account will automatically become members.

Is this account good for students?

Yes, this account is great for students who are 18 years or older.

It requires no minimum balance, so students won’t be charged for a low balance in the account. We also offer added benefits for university students such as our Texas State SuperCat debit card. Students enrolled at Texas A&M can earn entries into our annual Tuition Takedown Giveaway by using their debit card associated with this free checking account.

Does it cost anything to open a student checking account? Are there any annual fees?

To open a student checking account, you must currently be a member of the credit union or establish your membership by opening a savings account. This can be done online or in a branch with a deposit of $5.

The checking account can be opened at the same time with an additional deposit of $25.

This amount will cover the cost of your first box of checks, if you want to order them. There are no monthly service fees, monthly maintenance fees, or annual fees for either a checking or savings account.

Why is a deposit needed to open the checking account?

The $25 initial deposit to open a checking account is to verify funds for the account. It is available for access and withdrawal the next business day. After that, there are no monthly fees, and no minimum required balance for your checking account.

What kind of savings accounts does Greater Texas Credit Union offer?

When it comes to savings accounts, we offer a variety of options.

Our Regular Savings Accounts allow members to build up savings over time. Money Market Accounts offer higher interest rates than the regular option, or you can save for retirement with our IRAs.

Members can also save for the holidays throughout the year with our Christmas Club Accounts, or pay for health expenses through our tax-advantaged Health Savings Accounts.

Does there have to be a minimum amount in a checking or savings account at all times?

We do not require a minimum balance in the checking account. For savings, the minimum account balance is $5.

How long does it take to receive my debit card by mail after opening a checking account?

Once the checking account has been opened and the debit card has been requested, it should take 3-5 business days to receive the debit card in the mail.

.png)