A Different Breed of Diversification

A Different Breed of Diversification

When Should You Refinance Your Mortgage? [Guide]

When Should You Refinance Your Mortgage? [Guide]

It's hard work finding your dream home and getting the mortgage to pay for it. By the time you've looked far and wide for a house in your price range, and jumped through all the hoops to secure your loan, you'll probably be happy to sit tight for a few years.

Read More

The Basics of Qualifying for a Mortgage Loan

The Basics of Qualifying for a Mortgage Loan

Your home may be the largest purchase you ever make. Deciding to buy a home is a big decision, so it’s essential to ensure it’s a thoughtful choice too. Taking the time to understand how qualifying for a mortgage loan works will help make the process as rewarding as exciting.

Read More

Why Get a Mortgage Loan From a Credit Union?

Why Get a Mortgage Loan From a Credit Union?

Whether you’re a first-time buyer or an experienced house flipper, you may have questions about credit union mortgage loans. How are they a different type of mortgage than the one you can get from a commercial bank?

How To Endorse & Deposit Someone Else's Check

How To Endorse & Deposit Someone Else's Check

If you have a checking account, you've probably dealt with depositing checks. In general, checks are meant for the person they are written out to. When you are the payee, you're the only person that can do anything with that check.

Discover How Much You Should Keep In Your Checking Account

Discover How Much You Should Keep In Your Checking Account

Most people who have money in a bank have at least a portion of their money in a checking account. However, how much money you should keep in your checking account can be a difficult question and depends on several factors.

Read More

Joint Checking Accounts: Right For You?

Joint Checking Accounts: Right For You?

If you haven’t considered opening a joint account to manage shared finances, it might be a good option for you under certain circumstances. Joint bank accounts aren’t just for married couples. There are many situations where it might work to each party’s advantage to merge rather than maintain separate accounts.

Read More

What You'll Need to Open a Checking Account

What You'll Need to Open a Checking Account

Whether this is your first checking account or one of many, preparing the documentation you need before you head to the bank will make the process smooth and simple. Opening a checking account can be quick and painless, especially if you have your things in order.

Read More

How Checking Accounts Affect Your Credit Score

How Checking Accounts Affect Your Credit Score

Credit scores are more important than many people think. Yes, they’re used to help lending institutions determine whether someone is an acceptable risk for a loan, but they’re also used for other purposes.

Read More

4 Benefits Of Auto Loan Pre-Approval

4 Benefits Of Auto Loan Pre-Approval

It’s no secret that car shopping is an important yet stressful process, but there are certain actions you can take immediately to make your big-ticket purchase a far simpler affair.

Read More

Understanding Car Loan Length

Understanding Car Loan Length

Like any other loan, car loans have a certain length or period of time in which you can pay it back. The right car loan length for your situation will depend on a few factors, and often, it will come down to balancing a lower amount of interest with overall affordability.

Read More

Do You Know How Car Loans Work?

Do You Know How Car Loans Work?

Given the expense of cars, especially brand new models, it’s often necessary to get a car loan to cover the costs. Here, we’ll discuss how these loans work.

Read More

.png) 5 Ways To Pay Off Your Car FASTER!

5 Ways To Pay Off Your Car FASTER!

(Opens in a new Window)

Mortgage Loan Frequently Asked Questions (FAQs)

Mortgage Loan Frequently Asked Questions (FAQs)

Taking out a mortgage can be confusing and seem like a difficult path to navigate. There are common questions that crop up from new and experienced homeowners alike, so we’ve put together a guide of FAQs about mortgages to serve as a quick reference. The questions are divided by category to help you find the answer to your question.

Read More

.png) 4 Tips for Paying at the Pump

4 Tips for Paying at the Pump

(Opens in a new Window)

.png) Beware of Mortgage Fraud

Beware of Mortgage Fraud

Preparing to purchase your dream home is super-exciting. That's partly because you're choosing a property that may be your home for the next few decades. While you're busy tending to everything on your list, be careful not to let this hectic time turn into something sinister. Scammers are targeting hopeful new homeowners. Here's what you need to know about mortgage fraud.

Read More

Six Ways to Save on Summer Vacation

Six Ways to Save on Summer Vacation

The ocean is calling - and so is the open road. Your dream vacation awaits! But first, you need to work out the financial details. How are you going to pay for your getaway? How much can you realistically spend? Where is the money for your vacation going to come from?

Read More

Paying for College

Paying for College

It's spring - that time of year when colleges and university start ramping up the annual contest of which school will get which graduating high school senior. It's a fun and exciting time for most students, but for may parents, it can bring panic and worry. How in the world are they going to pay for it all?

Read More

5 Ways to Build Credit Now

5 Ways to Build Credit Now

Here are five ways we can help you get your credit rating going in the right direction if you’re just starting out, or boost your credit rating at any time.

Read More

.png) How To Be a Competitive First-Time Home Buyer in Austin's Hot Market

How To Be a Competitive First-Time Home Buyer in Austin's Hot Market

Austin has been a growing city for many years. Now, this quirky little city known for punching above its cultural weight is shedding its “Keep Austin Weird” vibe as it takes its place among America’s most vibrant centers of dynamic innovation.

Read More

Consider a Credit Union

Financial institutions aren’t all created equal. Some are big, some are small, some offer great savings rates and others don’t pay interest at all. If you’re dissatisfied with your bank, it might be time to look elsewhere.

Read More

A Different Breed of Diversification

A Different Breed of Diversification

Share certificates allow you to earn a good return on your money while keeping it accessible for use for major expenses.

Read More

10 Terms Every Home Buyer Should Know

Buying a house is a common undertaking for many Americans, but it's also one of the most complicated — not to mention costly — purchases adults will ever make.

Read More

Dreaming of Your First Home

Dreaming of Your First Home

Buying a home is a big deal, and it pays to get your ducks in a row before you make an offer. Here are some important steps to take.

Read More

Is the 4% Rule Still Valid?

Is the 4% Rule Still Valid?

Since the 1990s, the 4 percent rule of retirement withdrawal has been a guiding light in estimating whether investors will have enough money to last the rest of their lives. But economic conditions and market volatility have called this rule into question.

Read More

.png) Want to Graduate with Minimal Debt? Choose the Right College

Want to Graduate with Minimal Debt? Choose the Right College

The average amount of student loan debt that undergraduates have at graduation varies by college and state. Prospective students should research the amount of debt that graduates of various colleges typically have before committing to a campus.

Read More

How To Spot Credit Repair Service Scams

Have you seen ads about repairing your credit that offer you a fresh start by clearing any bad credit you have? Be cautious of these.

Read More

Car Shopping? Weigh Your Options Before You Make a Move

As any car owner will tell you, choosing the right car involves decisions, decisions and more decisions. Among the first and most important is determining where to buy the vehicle and how to finance it.

Read More

Small Interest Rate Changes

As the domestic economy improves, rate hikes are likely and the Federal Reserve has already signaled that they are considering increases.

Read More

Tips for Buying a Car

Searching for the perfect car and how to obtain it can be a real hassle. Here is a list of situations you should think about before buying a vehicle.

Read More

What is A Simple Interest Loan?

When it’s time to purchase a new car, most people take out an auto loan. This type of loan is considered a simple interest loan. You may be wondering how it all works?

Read More

How Credit Unions and Banks Differ

Open an account in a credit union and you're a member. Do the same with a bank and you're a customer. What's the difference?

Read More

Buying Big Ticket Items

The next time you make a large purchase - whether it's a new appliance, sectional sofa, or other costly item - don't automatically reach for your credit card.

Read More

Today's Mobile and Digital Payment Options

When we make a purchase these days, most of us don't use cash or write out a check; and given the emergence of digital payment options, soon we may not rely on our debit and credit cards either.

Read More

Avoiding Internet Scams

While the Internet is a great place to learn and obtain information, it is also a great place for con artists to scam innocent victims.

Read More

How To Avoid "Vishing"

Vishing is short for “voice phishing” where the goal of the thief is to access your identity and money using the telephone. The goal is to get you to reveal information related to your account that would grant unauthorized access.

Read More

5 Tips: Public Wi-Fi Safety

Some people are connecting without truly realizing the security risks of using Wi-Fi “hot spots.” Let’s take a look at some important tips to consider to keep you safe while using a Wi-Fi network.

Read More

Protect Your Checking Account

Check fraud is a serious problem in the United States. You should do all you can to protect unauthorized access to the funds in your checking account. Here are some important tips to follow in this effort.

Read More

Increase Your Car's Life Span

Following a simple checklist will keep you focused on necessary to-do's that can keep your car running longer.

Read More

Protect Your Card At The Pump

When you’re running low on gas remember these four helpful tips before you fill up it could save you from being a criminal's next victim.

Read More

Benefits of Sprucing Up Your Home

If you've been thinking about giving your home some updates, now may be a good time to move forward on home improvement projects. Giving your home some renovations can increase your home's value.

Read More

Refinancing Auto Loans 101

If you're paying too much in interest for your car or truck loan, refinancing could be a great way to save some serious dough. The process is fairly simple.

Read More

Five Smart Financial Resolutions

"Manage finances wisely" is a popular New Year's resolution, but it can be tough to stick to a goal so vague. Here are some specific ways to help you get money-smart in 2024.

Read More

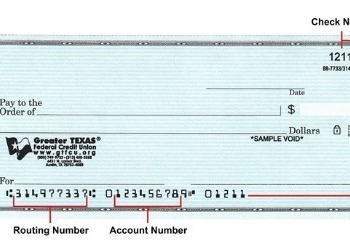

What is Your Routing / ABA Number?

The routing number for Greater Texas credit union and Aggieland credit union is 314977337. The Routing Number is also called an ABA number or routing transit number. You can also find it in the lower left-hand corner of your checks.

Read More

5 Reasons to Use a Credit Union

Comforts like smartphone bank deposits are nice, but how much are they costing you? Your statement might not show the costs directly, but there's an old adage about situations like this: If you're not paying for a service, you're not the customer. Do your research and see for yourself how credit unions compare to for-profit banks. Consider these five categories.

.png)

.png)

.png)

.png)

.png)