A checking account offering all of our essential services.

Essential Checking provides the tools you need to conduct your important day-to-day business quickly and securely. Best of all, you don’t need a perfect banking record to qualify for Essential. Essential Checking can give you an opportunity to start anew.

Open your Essential Checking Account today! Visit your local branch for more details and qualifications.

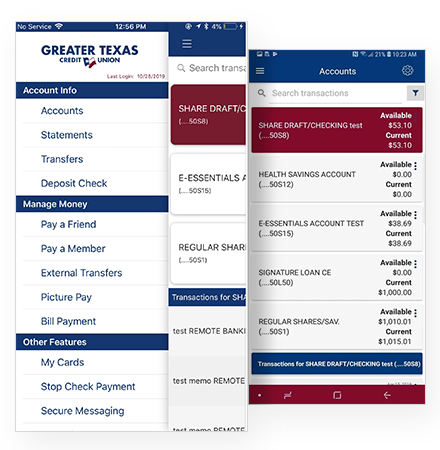

Newly Designed Mobile Banking App

- View your account balance(s)

- View account activity

- Transfer funds

- Locate a branch or ATM

Start Over and Get the Most Out of Your Essential Checking Account

- Personalized Debit Card

- Access to Non-GTFCU ATMs

- Knowledgeable, Personalized Customer Service

- Nationwide Access

- Overdraft Protection

- Online & Mobile Banking

Plan For Your Future With Essential Checking

Your life is busy. Between school, work, your social life, and spending time with family, you don’t want to add worrying about where you keep your money to the list. Opening an essential checking account allows you to ensure your funds are protected at a credit union you can trust while you enjoy your life.

Keeping a little cash on hand is fine, but nothing beats the ease of debit card access. What are you waiting for?

★★★★★

“I have had bank accounts in small town banks to big box banks. I have to say I have been extremely pleased with the service and support this institution offers. It has by far the best rates on Auto/Home loans. It is a very easy process to apply online and get approved. Once I actually walked into the dealership and found out they were a participating lender, I never saw a bank officer and got to sign all documents online with my iPhone and left with my car the same day. This is the longest I have stayed with one bank (3 years) and I am never going anywhere else! Nothing to complain about here!”

- Current Member

1 Essential Checking account subject to approval. Aggieland Credit Union retains the right to inquire about past banking history with reporting agencies such as Chexsystems.

You may not qualify for an Essential account if you have more than two (2) unpaid records or if the amount(s) of your unpaid record(s) is/are deemed to be “excessive”. Aggieland Credit Union will define “excessive” at our sole discretion.

2 Overdraft Privilege subject to qualification standards; please ask for details.

What Members are Saying

Frequently Asked Questions

Can I open an Essential Checking Account online?

Yes, members can open this second chance banking account online. Non-members can establish their credit union membership online to open an essential checking account at the same time. Learn how to open an account online

Do I have to be a member to open this account? Does every authorized user have to be a member?

Our essential checking account is only available to members, and any other authorized users must qualify for membership, as they automatically become members when they’re added to the account.

Becoming a credit union member is quick and easy, and you can open your checking account when you register with us by opening a savings account online or in-person at one of our branch locations.

How quickly can a new member open an account?

Open a new credit union account online today(Opens in a new Window) and start taking advantage of our financial products and services.

A small, quick, and convenient initial deposit of $5 in a savings account gets you started as a Greater Texas Credit Union member.

Start your essential checking account with a $25 initial deposit that will be available for withdrawal the next business day!

What kind of savings accounts does Aggieland Credit Union offer?

One of the benefits of credit union membership is the range of options designed to help you attain your goals and succeed. We offer a range of savings accounts to meet your needs, no matter what your situation or circumstances:

- Regular Savings Accounts Members build up savings over time.

- Money Market Accounts Higher interest rates than Regular Savings Accounts and the option to save for retirement with our IRAs.

- Christmas Club Accounts Members can save for the holidays throughout the year.

- Health Savings Accounts Tax-advantaged way to pay for health expenses.

Why is a deposit needed to open savings an checking accounts?

A $25 initial checking account deposit verifies funds when you open your account. The deposit is required even if you don't want to order checks. It is available for access and withdrawal the next business day. A savings account only requires $5, which stays in the account throughout the lifetime of the account.

After you pay your initial deposit, your checking account carries no required minimum balance or monthly maintenance fee.

Does there have to be a minimum amount in my savings account at all times?

Although we don’t require a minimum balance for our checking accounts, we do require a minimum account balance of $5 in the savings account that you opened when you registered as a Greater Texas Credit Union member.

How long after I open my checking account will I receive my debit card?

You will receive your debit card by mail within 3-5 days of opening your checking account.

What is the routing number for Aggieland Credit Union?

Our routing number is 314977337.